Most sports fans tend to assume that once pro athletes retire, they have saved enough money to live comfortably for the rest of their lives. To be fair, it’s not wrong to assume that NFL and NBA stars are set for life. However, there are always exceptions to this. After all, former athletes aren’t always responsible when it comes to managing money, just like the rest of us.

But if they make a financial error, it ends up costing them millions. In fact, there is a surprisingly long list of former NFL and NBA players who lost millions of dollars and sometimes lost everything after retiring. Some of these stories are crazy to think about and hard to believe, but let’s check out some of the most famous NFL and NBA players who experienced serious financial problems after their playing days were over.

Delonte West

(Getty Images)

West, once a promising NBA player known for his versatility and tenacity on the court, faced a stark reversal of fortune after retiring from professional basketball. Despite earning millions during his career, West’s financial woes emerged as a distressing reality post-retirement. Battling with mental health issues and substance abuse, West struggled to manage his finances effectively, leading to a rapid depletion of his wealth. His story serves as a poignant reminder of the challenges athletes often face in transitioning from the spotlight of professional sports to the uncertainties of life after retirement.

As news of West’s financial struggles surfaced, it sparked discussions about the importance of financial literacy and mental health support for athletes transitioning out of sports. While his journey embodies the pitfalls that can accompany sudden wealth and fame, it also highlights the need for greater awareness and resources to assist athletes in navigating life beyond their playing days. Despite the setbacks, there remains hope for West’s future as he seeks to rebuild his life and inspire others with his resilience in overcoming adversity.

Chris Andersen

(Getty Images)

Andersen, affectionately known as the “Birdman” during his NBA career, experienced a tumultuous journey post-retirement that saw him facing significant financial challenges. Despite earning millions during his time in professional basketball, Andersen found himself grappling with financial instability after retiring from the sport. Poor financial management, coupled with unexpected expenses and investments gone awry, contributed to Andersen’s financial downfall, highlighting the importance of financial literacy and planning for athletes transitioning out of their playing careers.

Andersen’s story serves as a cautionary tale, shedding light on the harsh realities that many athletes face once the cheers fade and the paychecks stop coming. His experience underscores the need for comprehensive support systems and education programs to help athletes navigate the complexities of managing their finances and planning for life after retirement. As Andersen works to rebuild his financial standing and forge a new path forward, his journey serves as a reminder of the importance of resilience and seeking assistance when facing financial challenges.

Vince Young

(Getty Images)

It took just seven years for Young to go from the third overall pick in the NFL Draft to filing for Chapter 11 bankruptcy. His financial advisor blames it on Young spending money faster than he was making it. That says a lot for a guy whose rookie contract was worth nearly $26 million in guaranteed money.

For what it’s worth, spending tens of millions of dollars isn’t easy, although Young made it look easy. He would buy expensive cars and just about anything else with a high price tag. Yet, when he filed for Chapter 11, Young’s assets were worth less than $1 million and he owed upwards of $10 million. He also lasted just six years in the NFL, so Young didn’t have a good way to get out of debt quickly.

Chris McAlister

(Getty Images)

After being a top-10 pick, McAlister spent a decade playing for the Ravens. He was a three-time Pro Bowler in Baltimore and won a Super Bowl ring when the Ravens won Super Bowl XXXV. At one point, he signed a seven-year, $55 million contract, so money shouldn’t have been a problem for him, even though McAlister declined swiftly and ended up being cut by the Saints midway through what would become his final season in the NFL.

McAlister last played in 2009, but by 2011, he was already in a bad place financially. We don’t know where the money went, but in 2011, McAlister asked a court to reduce his monthly child support payments. McAlister has a daughter despite only being married for three months. On his application for reduced childcare payments, he claimed that he was living with his parents, who were covering his living costs. In other words, he fell a long way in a short period of time.

Ray Williams

(Getty Images)

Williams played in the NBA for different teams over his nine-year career, earning roughly $2.5 million. He was at his best during the 1980s, averaging at least 19 points per game over three straight seasons for the Knicks and Nets. Even though he never made the All-Star Team, there were times when he was a bucket waiting to happen. However, soon after his retirement in 1987, things fell apart.

Williams applied for his NBA pension soon after retiring due to financial difficulties. After declaring bankruptcy in 1994, received his $200,000 NBA pension. But then he moved to Florida with that money and became the victim of a real estate scam. That money disappeared quickly and Williams ended up living in his car before some of his former teammates rallied to help get him back on his feet. Sadly, Williams passed away from colon cancer in 2013 at the age of 58.

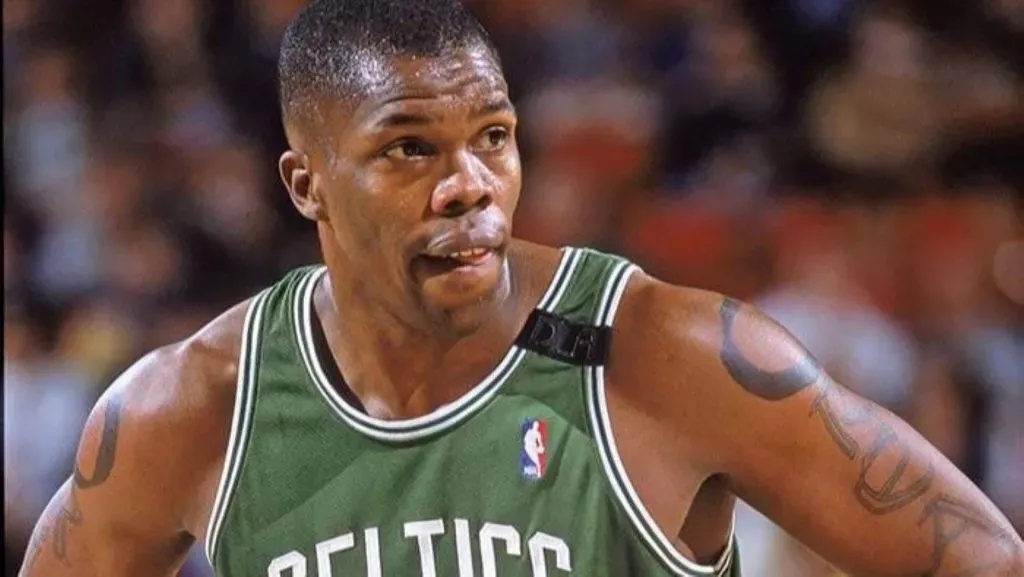

Kenny Anderson

(Getty Images)

The best years of Anderson’s 14-year NBA career came during his early days with the Nets. That’s when he made the All-Star Team in 1994 when he scored a career-high 18.8 points per game. While he declined during the second half of his career, Anderson was able to play in the league for a long time. For his career, Anderson averaged 12.6 points and 6.1 rebounds per game. He also took home over $63 million in salary before retiring.

Despite making tons of money, Anderson found himself in a difficult financial situation during his retirement due to a variety of reasons. He had multiple DUI charges and also fathered seven kids with five different women, so child support payments and divorce settlements drained his savings in a big way. Anderson also battled psychological and emotional problems in addition to financial hardships. However, Anderson was able to pull himself out of financial trouble with his journey being documented in the 2017 documentary Mr. Chibbs.

Andre Rison

(Getty Images)

Rison had something of a rollercoaster career despite being one of the most talented wide receivers of his generation. He was a five-time Pro Bowler who spent his best years with the Falcons and also won a Super Bowl ring as a member of the Packers. The guy with the nickname Bad Moon finished his career with over 10,000 receiving yards and 84 touchdowns. He later played in the CFL and won a Grey Cup.

Off the field, Rison had some issues. He had a turbulent relationship with Lisa Lopes of the group TLC, a relationship that included Lopes being charged with arson. Rison also led an extravagant lifestyle, frequently paying the tab for an entire group of friends while at clubs and reportedly spending $1 million on jewels. Naturally, the money ran out, forcing Rison to file for bankruptcy in 2007 when he had trouble with childcare payments. Later, Rison became a high school coach but surely had to adopt a more modest lifestyle with that kind of salary.

Sidney Moncrief

(Getty Images)

Currently, there are no records of Moncrief’s earnings during his 11-year NBA career, although his estimated earnings are around $7.2 million. His most notable years came with the Bucks with Moncrief being a five-time all-star. But perhaps his biggest claim to fame is being the first guard to win Defensive Player of the Year honors twice, making him one of the best two-way guards in NBA history.

However, the millions he made as a player disappeared quickly. After retiring, Moncrief started a car business in his native Arkansas and worked as an assistant with the Dallas Mavericks. From there, we’re not sure what happened, but Moncrief declared bankruptcy in 2005 with several car dealerships and even a local newspaper on his list of debtors. While trying to sort out his financial woes, Moncrief worked as a coach for the Fort Worth Flyers in the NBA G-League and a sports analyst for Fox Sports.

Travis Henry

(Getty Images)

Being a parent can be expensive. Just fathering kids can also be expensive. The latter is part of what got Henry into financial trouble. The former NFL running back has fathered at least 11 children with 10 different mothers. That’s a lot of child support payments that have to go to a lot of different people.

Not surprisingly, Henry had trouble keeping up and he was arrested in 2009 for failing to pay child support. His lawyer said that Henry had to pay around $170,000 per year in child support. Keep in mind his immaturity and drug use caused the Broncos to dump Henry one year into a five-year, $22.5 million contract that ended his career. With other legal problems on top of his child support payments, Henry ended up going broke.

Adrian Peterson

(Getty Images)

Peterson’s career was filled with both highs and lows. He’s likely to be remembered as one of the best running backs of all time. Peterson won MVP honors in 2012 when he rushed for over 2,000 yards and still owns the record for most rushing yards in a single game. He was also a seven-time Pro Bowler and had a career that was far longer than the average running back, helping him to earn well over $100 million in salary.

Unfortunately, Peterson has had several legal problems along the way. He also made several bad investments and then had to take out loans to cover up those investments. Ultimately, he owed several million dollars to multiple creditors with courts forcing him to multiple settlements after he defaulted on loans. In fact, one reason why Peterson’s career lasted so long is he had to keep playing so he could pay back what he owed.

Rick Mahorn

(Getty Images)

When you consider that Mahorn made less in 18 seasons than some players in his identical capacity today make in a single season, it makes his financial problems a little more believable. For his career, Mahorn took home an estimated $8.5 million in salary. While he never filled up the stat sheet, he was a key part of the Pistons during their 1989 title run. He eventually retired averaging 6.9 points per game for his career.

It was about 10 years that Mahorn was hit by financial difficulties. Despite having both an NBA pension and a healthy salary as a WNBA coach, Mahorn declared bankruptcy in 2009. After defaulting on his mortgage, he owed the IRS $200,000. Fortunately, serving as a broadcaster for the Pistons and serving as a coach in rapper Ice Cube’s Big3 league helped to get Mahorn out of the red financially.

Johnny Unitas

(Getty Images)

If only Unitas was as good at making investments as he was at playing quarterback. In 1984, he invested a huge percentage of his life savings in a company that quickly flamed out. By the early 90s, he and his wife were in serious financial trouble and declared bankruptcy after falling $3.2 million in debt.

In addition to financial ruin, Unitas suffered many physical consequences from his long career in football. His knees were bad and his right hand was quite limited. Sadly, Unitas had to live with those physical shortcomings and financial difficulties during the latter years of his life.

Erick Strickland

(Getty Images)

Strickland played nine NBA seasons with six different teams. His career stats were nothing special, averaging just 7.5 points per game. But those nine seasons in the league earned him around $13 million. However, most of that money would end up being lost thanks to someone who Strickland thought he could trust. Strickland was approached by a buddy with what he thought was a great real estate investment. Even Strickland’s father researched it for his son and found that it appeared to be a fruitful opportunity.

Strickland made an investment with the intention of selling the property for a significant profit. It turned out that the person he believed to be a friend had taken advantage of the Stricklands because the investment property wasn’t even worth half of what they had anticipated. Strickland and his friend had a falling out and the nest egg he built from his playing days was gone.

Michael Vick

(Getty Images)

At the peak of his career around 2006, Vick was one of the highest-earning athletes in the U.S. However, a slew of legal problems spelled disaster for his finances. He made bad investments and saw his former agents file a $45 million lawsuit against him. Amidst his dogfighting charges the following year, Vick was temporarily out of the NFL and lost endorsement deals.

In 2008, Vick had no choice but to file for bankruptcy after his finances continued to be managed poorly and money was thrown away while he was in prison. It was a complicated process, to say the least, as Vick had to sell several homes to help settle the debts. The silver lining is Vick was able to return to the NFL for seven more seasons, getting himself out of debt and rebuilding part of his fortune before retiring.

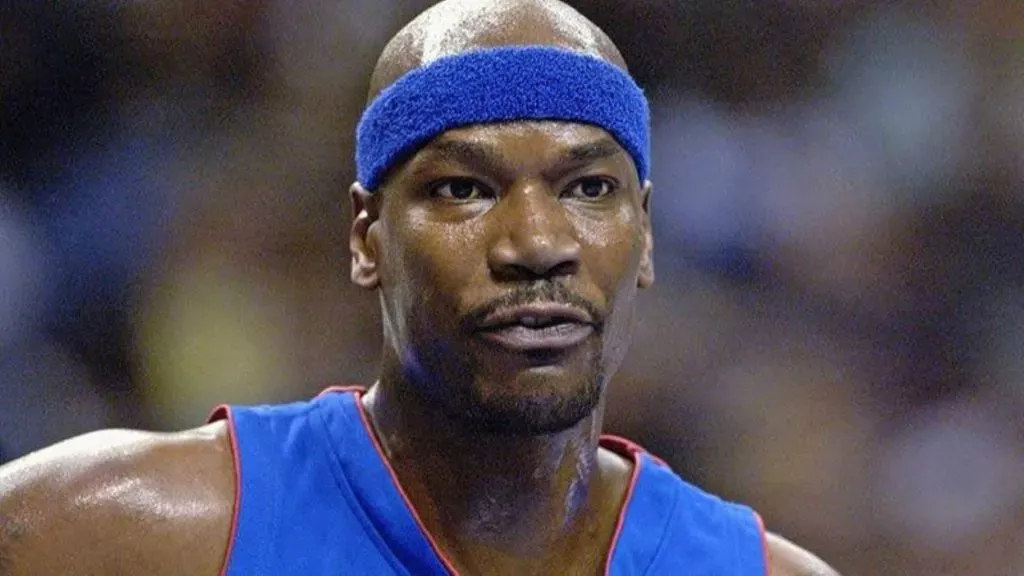

Derrick Coleman

(Getty Images)

Coleman may not be the best player to be drafted first overall, but he did parlay an exceptional college career at Syracuse into a solid NBA career. Coleman won Rookie of the Year honors in 1991 and was also an all-star in 1994. He played for four different teams, including two stints with the 76ers, over 15 seasons, averaging 16.5 points and 9.3 rebounds per game during his career. Even if he never became a perennial all-star, Coleman was able to earn over $91 million during his career.

But just a few years after retiring in 2005, Coleman declared bankruptcy in 2010. Most of the blame for his money woes comes from excessive drinking and an extravagant lifestyle. However, Coleman eventually started making better decisions. He returned to school to get his degree and now serves as a spokesperson for Syracuse University while also working with at-risk kids. Coleman has also helped to campaign for clean water in his hometown of Flint, Michigan. He may not be living a rich and flashy lifestyle anymore, but Coleman is doing a lot of good in the world.

Raghib “Rocket” Ismail

(Getty Images)

Blessed with great speed, Ismail had a great college career at Notre Dame and then spent a couple of years as a star in the CFL before carving out a long career in the NFL. He was even the MVP of the Grey Cup in 1991. Ismail never reached Pro Bowl status in the NFL, although he had a pair of 1,000-yard seasons, which allowed him to earn enough money to be set for the rest of his life.

Of course, that’s not what happened with Ismail. He took his NFL nest egg and invested in several businesses, including a line of cosmetic surgery supplies, a rock-and-roll-themed restaurant, a calligraphy company, and a machine that was supposed to dispense prepaid phone cards. Each and every one of them failed, costing Ismail his fortune and essentially forcing him to work as a sports analyst and a Slamball coach in his retirement to make ends meet.

Randy Brown

(Getty Images)

An NBA journeyman, Brown is most remembered for his time spent with the Bulls from 1995 to 2000. During the majority of his career, Brown played off the bench and never averaged more than nine points or 3.5 rebounds per game. However, he had a strong defensive presence and was a frequent contributor off the bench during Chicago’s second three-peat. For his hard work, Brown took home a little over $15 million during this NBA career.

After retiring, Brown made the decision to go into business for himself, investing heavily in a number of restaurants and real estate ventures. Unfortunately Brown is another player who was misled by someone he considered a friend. After Brown’s investments failed, the Bulls hired him as their director of player development and eventually assistant GM to help save him from financial ruin.

Mark Brunell

(Getty Images)

After making roughly $50 million during his NFL career, Brunell ended up filing for bankruptcy in 2010 with just $5 million worth of assets and over $25 million in liabilities. After his playing days, Brunell was involved in some bad real estate investments and didn’t seem to have much of a knack for business.

Part of his business investment was purchasing a stake in nearly a dozen Whataburger locations, mostly in the Jacksonville area. But nearly half of those locations ended up failing and having to close. To help stabilize his finances, Brunell returned to the NFL in 2021 as quarterbacks coach of the Lions.

Mark Ingram Sr.

(Getty Images)

Before his son was a Heisman winner who had a long NFL career, Mark Ingram St. was a first-round pick who made a lot of money playing football. While his stats are a little underwhelming, the older Ingram spent 10 seasons in the NFL and won a Super Bowl with the Giants. But after he retired in 1996, his financial problems began. Ingram attempted to deceive the IRS while engaging in money laundering. He was caught and given a seven-year prison term, as well as some heavy fines.

Also, he failed to turn himself into authorities as required, which added many months to his sentence. After courts determined that he had broken the terms of his supervised release by having a firearm, failing to make a $500 monthly reparation payment, and failing to notify his probation officer of a change of address, he was sent back to jail in 2018, which was also costly financially. But perhaps his son can take care of him with the money he’s made from his NFL career.

Dan Issel

(Getty Images)

Issel is one of the best players in Nuggets’ history. He was a six-time All-ABA player, a seven-time NBA All-Star, and a member of the Basketball Hall of Fame. He played in the ABA with the Kentucky Colonels and then 10 seasons with the Nuggets. For his career, he averaged 22.6 points and 9.1 rebounds per game before returning to Denver with two stints as the head coach of the Nuggets. However, Issel had other interests besides basketball that would prove to be his downfall.

When Issel tried his hand in the business world, things went wrong, ultimately forcing him to declare bankruptcy in 2009. Issel reportedly had 34 different creditors and owed them a combined $4.5 million despite Issel taking home $18 million during his playing career. Some of the memorabilia from his career had to be auctioned off to pay off his debt, although Issel has been able to restore his good standing with the IRS.

Warren Sapp

(Getty Images)

Officially, Sapp made over $82 million as an NFL player. Even as an analyst, he was making $45,000 per month, which is a salary most people would take. However, Sapp found a way to lose it all and bungle his finances. Ultimately, he had no choice but to file for Chapter 11 bankruptcy with a total of $826 in his bank account.

With Sapp, financial problems likely came about because of careless spending. For instance, he spent $1,2000 on a lion-skin rug. Sapp owned an extensive shoe collection that included a pair of Jordan sneakers that cost $6,000. Eventually, all of his prized possessions were auctioned off, but even that wasn’t enough to pay off his debts, forcing Sapp to sell a 10,000-square-foot Florida home in 2012 to pay off everything he owed.

Dennis Rodman

(Getty Images)

In addition to being one of the most notable players in NBA history because of his antics and appearance, Rodman made over $25 million during his career as one of the top rebounders and defenders in the league. Unfortunately, he loved spending money even more than he loved rebounding. To his credit, Rodman has been described as a generous person who didn’t always spend money on himself.

Nevertheless, his spending habits got him into trouble, causing Rodman to go broke. He ended up owing $800,000 in child support and $50,000 in spousal support. A host of other legal issues over the years have also played a role in draining Rodman’s life savings. Of course, his tattoos serve as daily reminders of the money he spent on things that he can’t sell to get some of his money back.

Charlie Batch

(Getty Images)

Detroit. To his credit, he made for a decent backup in Pittsburgh for many years, winning two Super Bowls as a member of the Steelers. Even though he was a backup for most of his career, Batch was in the NFL from 1998 to 2012, which should have earned him enough money to live comfortably for the rest of his life. Backups don’t exactly make chump change, after all. However, late in his career, Batch had to file for bankruptcy. He did so in 2011, nearly losing his Super Bowl rings to pay off his debts.

Batch apparently owned 25 properties and made some bad real estate investments. When he filed for bankruptcy, Batch claimed that he was $8.3 million in debt. But while backup quarterbacks make a decent salary compared to the average person, his salary wasn’t enough to pay back his debts. While he’s not exactly living on Easy Street, Batch has gotten his act together, working as a broadcaster and doing work with the NFLPA.

Shawn Kemp

(Getty Images)

Kemp rose to fame In the early 1990s as a member of the SuperSonics. He and Gary Payton teamed up to lead the rise of basketball in Seattle. Kemp was an explosive and powerful big man who went to six straight All-Star Games during the peak of his career and nearly led the SuperSonics to the NBA title in 1996 before falling short against the Bulls. For his career, Kemp averaged 14.6 points and 8.4 rebounds per game and was paid more than $91 million over 14 seasons.

Unfortunately, in 2022, it was reported that Kemp’s net worth was almost zero. After retiring, he had some legal issues that were accompanied by hefty legal bills. It was also reported that Kemp was making monthly child support payments to six different families. In 2020, Kemp’s name was attached to a cannabis dispensary in Seattle that he started to help him to start making money again. However, Kemp’s legal woes have continued, as have his financial hardships.

Antoine Walker

(Getty Images)

Over his entire NBA career, Walker’s earnings are north of $100 million. That’s the kind of money you get after 13 seasons in the league, especially as a three-time all-star. But even an estimated $108 million isn’t an infinite amount, especially when you refuse to wear the same suit twice and support 70 friends and family members at various times, both of which Walker did.

Walker first got himself into trouble by writing checks to casinos for over $1 million. That foolish decision was just a precursor to Walker filing Chapter 7 bankruptcy in 2010, claiming he had over $12 million in debts and assets of a mere $4.3 million. His college teammate Nazr Mohammed had to chip in for half of his attorney’s fees during the bankruptcy proceedings. Walker was out of debt by 2013 but only after selling his NBA championship ring.

Lawrence Taylor

(Getty Images)

Part of Taylor’s problem is that elite defensive players during his era didn’t make the kind of money a player of his stature would today. But his other problem is that he liked to spend money on things that he didn’t actually need, especially drugs. Taylor had a drug problem, which is a good way to lose a lot of money quickly and put yourself into debt.

In fact, Taylor once admitted to spending $1,000 per day on a combination of drugs and escorts. There was also a series of bad investments and legal issues that drained his bank account. Taylor compounded the issue by giving the IRS a false tax return. By 1998, he had to file for bankruptcy while later getting charged with failure to pay child support and tax evasion.

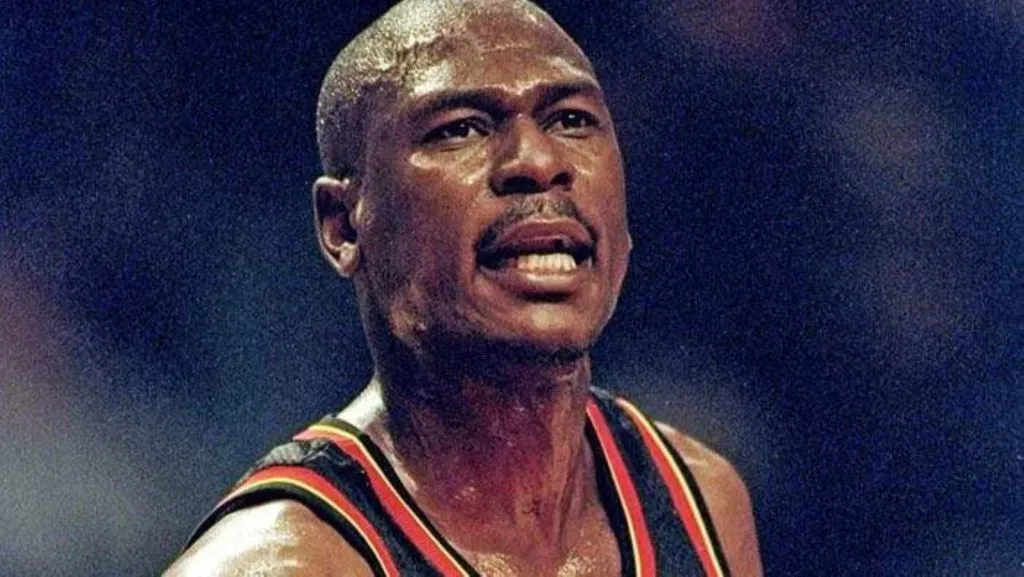

Mookie Blaylock

(Getty Images)

Blaylock will long be remembered as one of the finest point guards in Hawks history, at least before Trae Young showed up in Atlanta. During his time in Atlanta, he led the league in steals in back-to-back seasons and holds the franchise record for most steals. Blaylock was one of the best defensive players of his era, averring 2.3 steals per game during his career. But he also knew how to put the ball in the basket, averaging 13.5 points and 6.7 assists per game during his career, helping to earn him over $31 million in salary.

Unfortunately, Blaylock battled alcoholism and substance abuse during the latter stages of his career and his life after retirement. Much of his money was either devoured by the condition he had or went toward trying to defend himself in court. In 2013, Blaylock was the driver in a fatal car accident that claimed a woman’s life and almost his own. After pleading guilty, Blaylock served three years followed by eight years of probation, losing most of his money in the process.

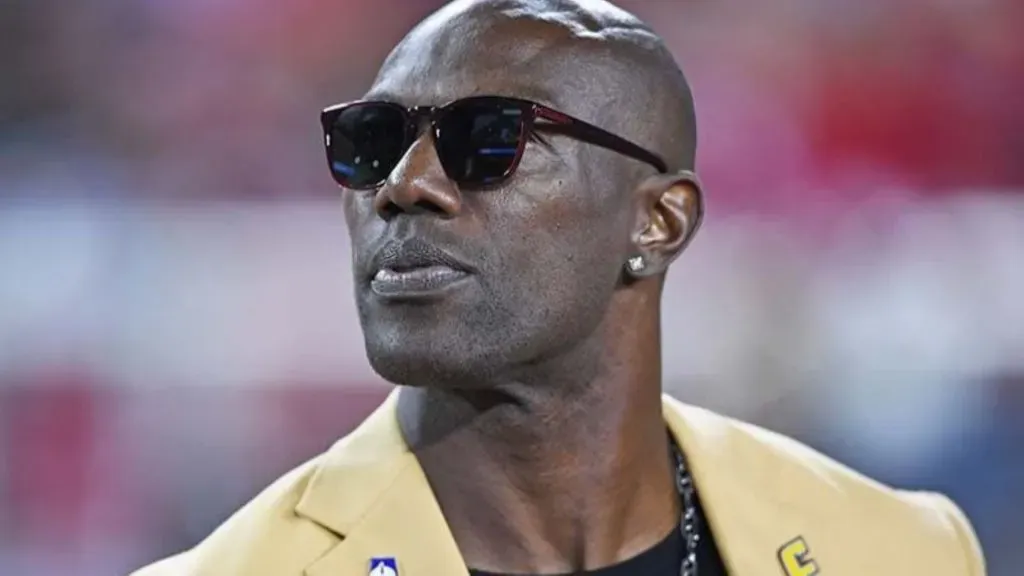

Terrell Owens

(Getty Images)

Between his salary and his endorsement deals, Owens made around $80 million during his time in the NFL. But it turns out Owens spent too much time coming up with elaborate touchdown celebrations, creating controversy, and doing sit-ups in his driveway to manage his finances properly. At one point, Owens had hit net worth down to roughly half a million dollars. He was paying about $45,000 per month in child support, which can make any fortune shrink in a hurry.

Owens actually lapsed on those payments for a while and nearly ended up going to jail because he either couldn’t or wouldn’t pay them. If you’re wondering why Owens spent time playing in the CFL and Fan Controlled Football, it’s more so because he needed the money rather than the love of the game.

Glen Rice

(Getty Images)

As a former top-five pick, Rice didn’t have the most memorable career, but he was an accomplished scorer and a three-time all-star. In six of his 15 seasons, Rice averaged over 20 points per game. He also contributed to the Lakers during their 2000 championship, starting almost every game of the season. His career ended with over $68 million worth of salary in his pocket and 18.3 points per game.

But a combination of poor business decisions and regular child support payments led to Rice’s post-basketball financial problems. Rice even asked a judge to reduce his monthly support payments so that he could live independently. To make ends meet, he started to rely on memorabilia sales, public appearances, and fees for signing autographs. But even that wasn’t enough to cover his expenses. In 2022, a judge finally agreed to reduce Rice’s monthly payments, which appears to have eased his financial trouble.

Latrell Sprewell

(Getty Images)

Sprewell is most infamous for his violent incident with coach P.J. Carleismo. That voided the contract he had with the Warriors, although Sprewell later sign a lucrative deal with the Knicks and make plenty of money. He also made some unusual comments in 2004 when he claimed that the three-year, $21 million contract the Timberwolves offered him wasn’t enough to feed his family, leading him to decline the offer.

In retrospect, perhaps Sprewell should have taken the $21 million and done his best to get by. A few years after his days in the NBA were over, he was sued by his former partner for $200 million, as she claimed that Sprewell promised to support her and their four kids. That lawsuit led to money problems that caused Sprewell to have his yacht and two homes foreclosed over the next couple of years. A few years after that, the state of Wisconsin claimed that Sprewell was $3.5 million behind in his taxes, putting him in even deeper financial turmoil.

Tiki Barber

(Getty Images)

On the field, Barber had a career that would make most running backs proud. He played all 10 of his seasons with the Giants, racking up over 10,000 rushing yards and going to the Pro Bowl three times. While outspoken at times, Barber appeared to be smart enough to avoid financial ruin during his retirement. In fact, he retired rather than sign a two-year, $50 million contract with the Giants, so he must have been in good shape financially.

Surprisingly, that didn’t turn out to be the case. Barber had issues with his personal life, as his 11-year marriage ended after he cheated on his wife with an NBC intern. That affair also cost him his job because he violated a “morality clause” in his NBC contract while working as a broadcaster. It turns out, Barber wasn’t that responsible off the field with money or his personal life. Fortunately, he’s found other broadcasting jobs and began hosting a daily radio show on WFAN in New York in 2022.

Eric Williams

(Getty Images)

Williams had a prosperous 12-year NBA career. Early in his career, he averaged 15 points per game over two seasons with the Celtics. After getting hurt during his third season in the league, Williams was never the same again. However, he was able to hang around the NBA for 12 seasons, making close to $40 million while averaging 8.6 points per game during those 12 seasons.

Unfortunately, about 10 years after his NBA career came to an end, Williams found himself without a home and seriously in debt. His situation worsened when he received a citation alleging that he was over $24,000 behind on child support payments. In recent years, Williams has managed to dig himself out of that financial hole, although he shouldn’t be particularly proud of blowing a nearly $40 million nest egg.

Deuce McCallister

(Getty Images)

As an NFL quarterback, McCallister banked around $70 million in salary. At one time, he was among the highest-paid running backs in the league. But within three years of retiring, virtually all of that money was gone. The biggest culprit was McCallister buying a Nissan dealership in Mississippi, which seemed like a good idea at the time.

However, McCallister was built to be a running back, not a businessman. Nissan ended up suing him for owing more than $6.6 million, plus interest, causing McCallister to file for bankruptcy on behalf of the dealership. Even after a settlement was ordered, McCallister failed to pay, forcing Nissan to sue him again. Along the way, McCallister saw his home auctioned off with his net worth down to about $50,000.

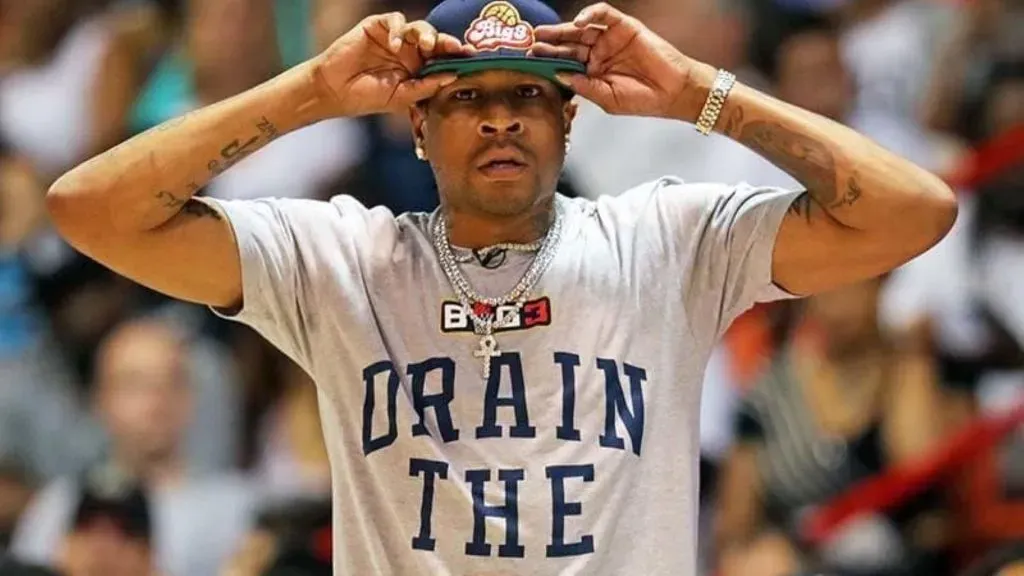

Allen Iverson

(Getty Images)

If you just looked at Iverson’s contracts, not to mention the expensive way he would dress, you’d probably think that he was just fine financially during his NBA career. Even for a big spender, it’d take a lot to lose all of his cash. Keep in mind that he made over $20 million in salary some years.

However, when his wife filed for divorce in 2008, there were reports that Iverson was in debt. He apparently spent freely, to the point that he reportedly bought new clothes everywhere he went rather than carry luggage (or hire someone to carry the luggage for him). When the divorce proceedings went to court, Iverson allegedly yelled at his former wife: “I don’t even have money for a cheeseburger!” However, publicly, he kept up the appearance that he had plenty of money, so perhaps the truth is somewhere in between.

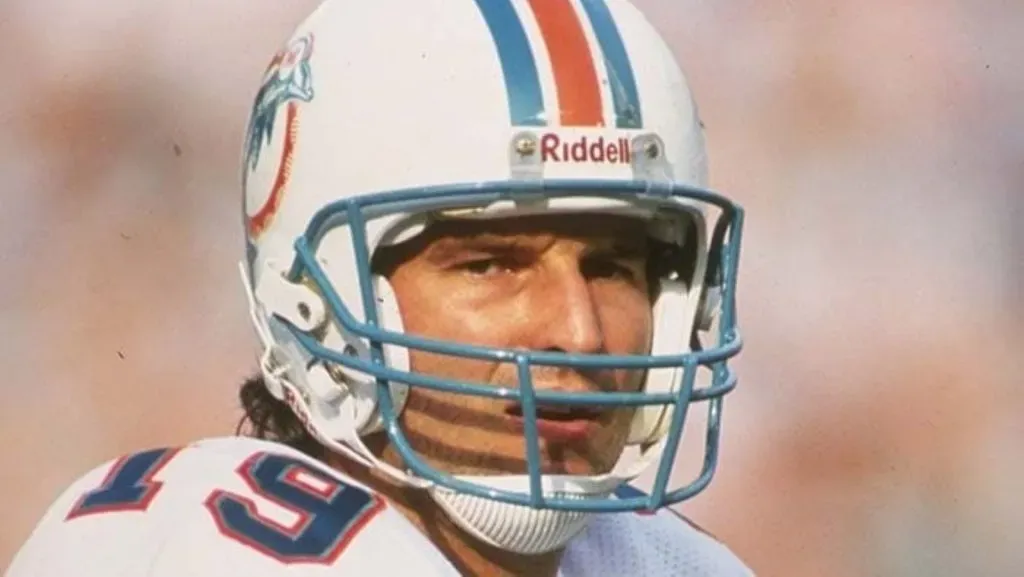

Dan Marino

(Getty Images)

Fortunately, Marino is better known for being the best quarterback to never win a Super Bowl than he is for his financial errors. Ideally, he’d rather be remembered as a former NFL and a nine-time Pro Bowler, not to mention leading the NFL in completions six times, which remains a record the Hall of Famer who spent his entire career with the Dolphins owns.

In any event, Marino followed up a spectacular career with some financial missteps after he retired. He backed a company called Digital Domain Media Group that worked on Apollo 13 and Titanic. However, when that company went bankrupt, Marino’s 1.6 million shares became worthless and he lost a reported $14 million. Despite taking a heavy loss on that investment, Marino is still able to get by thanks to his broadcasting gig on CBS.

William Perry

(Getty Images)

It should sadden to hear all NFL fans, especially Chicago fans, that the great William Refrigerator Perry fell on hard times after he retired. He was such a legendary figure for the Bears, especially when they won Super Bowl XX and he scored a touchdown. He made millions during his career and also made plenty of celebrity appearances both before and after he retired.

Unfortunately, a series of health issues, including diabetes, alcoholism, and Guillain-Barré syndrome have had a negative impact on his life and his finances. Things got so bad that had to sell his Super Bowl ring for $20,000 at an auction. In 2016, Perry reportedly had to move into a retirement home and is living off disability payments from the NFL and social security to support himself, a sad ending for a larger-than-life figure.

Clifford Robinson

(Getty Images)

During his playing career, Robinson was affectionately known as Uncle Cliffy. He wasn’t a bonafide superstar, earning just one all-star selection. But he was the NBA’s Sixth Man of the Year in 1993 and was one of the better defensive players of his era. But with tens of millions in the bank, Robinson filed for bankruptcy just two seasons after his retirement. According to the claim, he had assets worth $7.1 million but $12.4 worth of debt, putting him more than $5 million in the red.

To his credit, he ventured into the cannabis industry with a line of Uncle Cliffy products to help him get out of debt and get his finances back on track. Sadly, a stroke in 2017 left him partially paralyzed with Robinson passing away of lymphoma in 2020 at the age of 53.

Clinton Portis

(Getty Images)

Believe it or not, Portis was once the highest-paid running back in NFL history. It’s surprising because he only went to the Pro Bowl twice. While he was still early in his career, Portis signed an eight-year, $50.5 million contract that should have had him set for life. But after signing that contract, injuries got in the way of his career and poor financial decisions followed.

About five years after his last NFL game, Portis filed for bankruptcy. He claimed his financial advisors forced him to make bad investments and took more than $3 million out of his account. He later claimed that he didn’t fully understand what his advisors were telling him. A few years after filing for bankruptcy, he was one of a dozen former players accused of defrauding the NFL’s health program. Those players made a few million dollars worth of false claims with Portis eventually being sentenced to six months in jail.

Darius Miles

(Getty Images)

Miles was one of the more successful players to jump from high school to the pros, at least early in his career. He was one of the top rookies in the league during his first season and carved out a respectable career. Despite a knee injury ending his career prematurely, Miles played eight seasons in the NBA and made $62 million in addition to having a couple of movie roles.

But perhaps Miles skipped college entirely, he didn’t do a good job of managing his finances. He had an extravagant lifestyle and spent as if the money would never run out. But the money did run out, especially after several unsuccessful investments. About seven years after he retired, Miles was forced to declare bankruptcy.

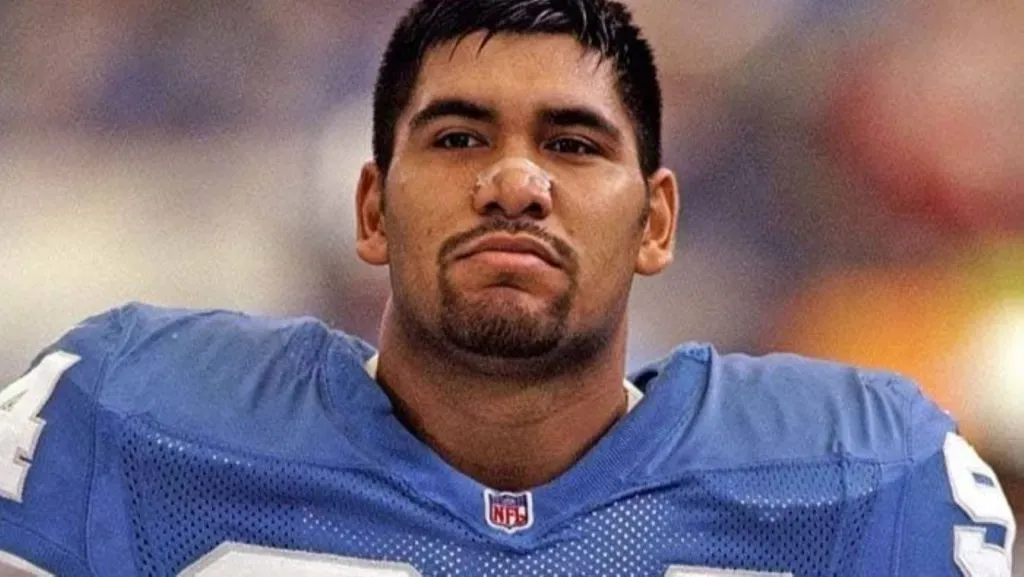

Luther Elliss

(Getty Images)

Fans of the Lions will probably remember Ellis more than most NFL fans. He played 10 seasons in the NFL, mostly in Detroit. Elliss went to two Pro Bowls and made well over $10 million during his career, which means he should have been set for life. AT least that would have been the case if Elliss had been more responsible with his money.

It turns out Elliss spent too much money on cars and jewelry in addition to making some bad investments. Within five years of retiring, he was $1.6 million in debt on his mortgage and didn’t have enough to pay it off, forcing him into bankruptcy. Elliss reemerged in the football world as a college coach in 2017, ultimately joining the staff of his alma mater Utah in 2022.

Joe Smith

(Getty Images)

After being the first overall pick in the draft, Smith had something of a journeyman career, playing for 12 teams in 16 seasons. Despite failing to find a permanent home or ever being an all-star, Smith’s longevity helped him amass over $60 million in career earnings. When all was said and done, Smith averaged 10.9 points and 6.4 rebounds per game.

Ironically, it was his constant movement between homes that ended up costing him. Smith claims that he purchased a brand-new home in each state where he competed, and by 2018, he was completely bankrupt. Perhaps he forgot that you’re supposed to sell homes when you move away. When Smith was in dire straights financially, it was Alex Rodriguez who saved him. A-Rod set up Smith with a financial counselor who assisted Smith in getting back on his feet and paying off his debts.

Bernie Kosar

(Getty Images)

There were high hopes for Kosar when the Browns drafted him out of Miami. That year, he signed a $6 million contract, and that was just at the start of a 12-year career. Kosar tried to focus on football while letting his father manage his money. But that turned out to be a bad decision.

Kosar’s father quickly spent the signing bonus he got from the Browns on cars and his mortgage. Between loans and general mismanagement, Kosar’s father ended helped to lose $15 million. Despite graduating from Miami’s business school and getting involved in some successful businesses, Kosar had to declare bankruptcy in 2009 when his business had just $9 million in assets and over $18 million in debt.

Christian Laettner

(Getty Images)

In addition to becoming the most despised player in college basketball history, Laettner had a successful NBA career that earned him more than $60 million. He played for six different teams over 13 seasons. While Laettner was only an all-star once, he played well enough in the pros to keep getting contracts, eventually averaging 12.8 points and 6.7 rebounds over his entire career.

After retiring, Laettner experienced financial hardship. He found himself on the verge of bankruptcy as a result of several poor business and real estate decisions. He not only owed $14 million to North Carolina creditors but he also conned one of his former teammates. Laettner partnered with Scottie Pippen in an effort to buy the Memphis Grizzlies. But the deal never came to fruition, and when Pippen didn’t get a return on his investment, he sued Laettner, his former Dream Team teammate, winning $2.5 million.

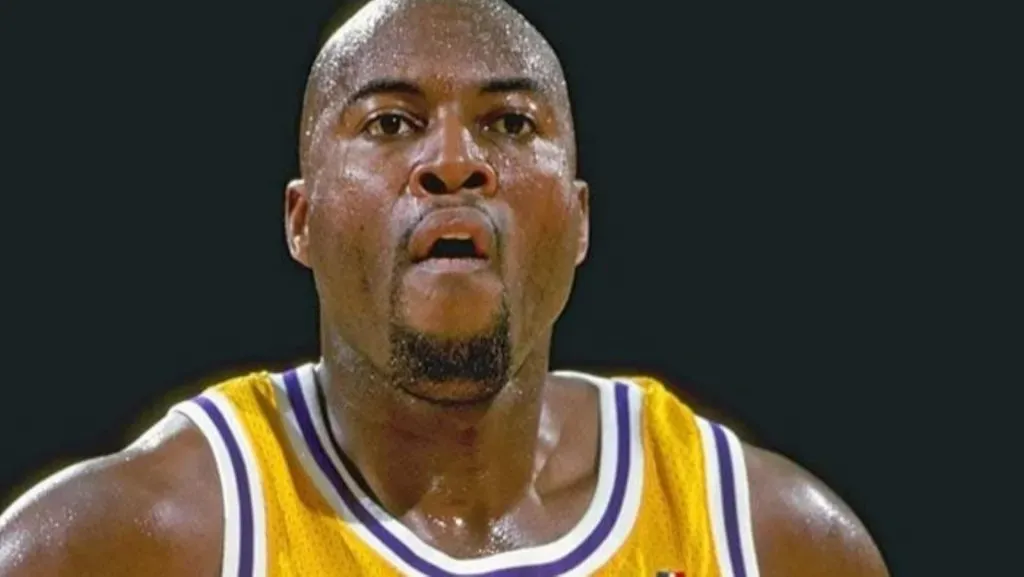

Larry Johnson

(Getty Images)

Johnson is one of the best power forwards in NBA history and a Hall of Famer. Even with chronic back problems slowing him down late in his career and forcing him into early retirement, Johnson put together an impressive career. He won Rookie of the Year honors after an incredible college career at UNLV and was an all-star in the NBA twice. Over his five years with the Hornets and five years with the Knicks, Grandmama averaged 16.2 points and 7.5 rebounds per game while collecting over $83 million, all by age 31.

Alas, Johnson’s early retirement was not exactly a blessing. His back problems necessitated costly medical procedures in order for him to function properly. Johnson filed for bankruptcy in 2015 when it was discovered he owed a colossal sum in child support. He owed one woman $890,000 in delinquent child support. Offering the woman his home in California was the only way he knew how to settle his obligation. The woman accepted the offer, which settled the matter, although it probably doesn’t leave Johnson with much money left to live too comfortably.

Dermontti Dawson

(Getty Images)

Few players are as revered by Steelers fans as Dawson. He spent his entire NFL career playing center for the Steelers, going to seven straight Pro Bowls and ultimately earning a place in the Hall of Fame. Naturally, he made a decent living, only to end up in financial turmoil, filing for bankruptcy a decade after his retirement.

After retiring, Dawson became a real estate developer. But he had a minority stake in a lot of ventures, so he didn’t have a lot of control over decisions being made. He ended up owning his partners close to $70 million while having just $1.4 million in assets. Dawson now makes a living as a sales rep but does still have part ownership in an independent baseball team.

Vin Baker

(Getty Images)

To date, Baker is one of the most popular players in Bucks’ history. He began his career in Milwaukee, where he made the all-star team in three straight seasons before becoming an all-star again after being traded to Seattle in 1997. Baker also played for the Celtics, Knicks, Rockets, and Clippers during his 13-year career. He eventually retired after making more than $97 million, averaging 15 points and 7.4 rebounds per game.

Unfortunately, Baker’s financial difficulties after his playing days ended have been well-documented. He battled alcoholism and addiction during his career, and those issues continued after he retired, putting a strain on his finances in the process. But after promising to get clean, Baker was able to turn things around. For a while, he was managing a Starbucks while trying to get on the right path. In 2018, Baker returned to the Bucks as an assistant coach, relying on the franchise that drafted him to help him stay on the straight and narrow.

John Elway

(Getty Images)

While Elway went to Stanford and had a Hall of Fame career with the Broncos, winning two Super Bowls, he’s not always made the best decisions off the field. When he was running the front office for the Broncos, he failed on multiple occasions to draft a viable quarterback. In 2010, he was also the victim of a Ponzi scheme, which you wouldn’t think would happen to a Stanford graduate.

Elway reportedly lost $15 million when he and his business partner invested in a hedge fund that turned out to be not such a good idea. On the bright side, Elway made other investments that have gone better and prevented him from wasting his money. For instance, late in his career, he sold five auto dealerships with his name for $82.5 million. He also owns four Denver-area steakhouses called Elway’s, so he had some good investments and never needs to worry about where to go for a good meal.

O.J. Simpson

(Getty Images)

Simpson’s legal troubles are well-documented, and hiring several high-priced lawyers to help get him acquitted of double-murder charges didn’t exactly come cheap. On top of that, Simpson lost a civil suit two years later that ordered him to pay $33.5 million to the families of the victims in his double-murder case. Any money that Simpson made after losing his civil case the Goldman family did its best to collect.

Most people don’t know that a tax lien was filed against Simpson in 1999, and by 2007, the state of California claimed he owed the state $1.44 million in unpaid taxes. Simpson’s financial situation didn’t improve after he was convicted of armed robbery and served nine years in prison before being given parole in 2017. He died on April 11, 2024 in Las Vegas due to prostate cancer.